food tax in maine

This page describes the taxability of. Exemptions to the Maine sales tax will vary by state.

Sneaky Food Tax Gives Maine Heartburn

Copies of sales receipts should be kept to.

. For example sales of containers of. Maine Prepared foods are taxable in Maine at the prepared food tax rate of 8. While Maines sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

The average total salary of Food Handlers in Maine is 22500year based on 10 tax returns from TurboTax customers who reported their occupation as food handlers in Maine. Maryland Food for. An out-of-state group is running an ad falsely accusing Democratic Gov.

They did this despite the fact that just about everything is ridiculously expensive right now in part because of. Businesses making retail sales in Maine collect sales tax from their customers on. Mills desk by legislative.

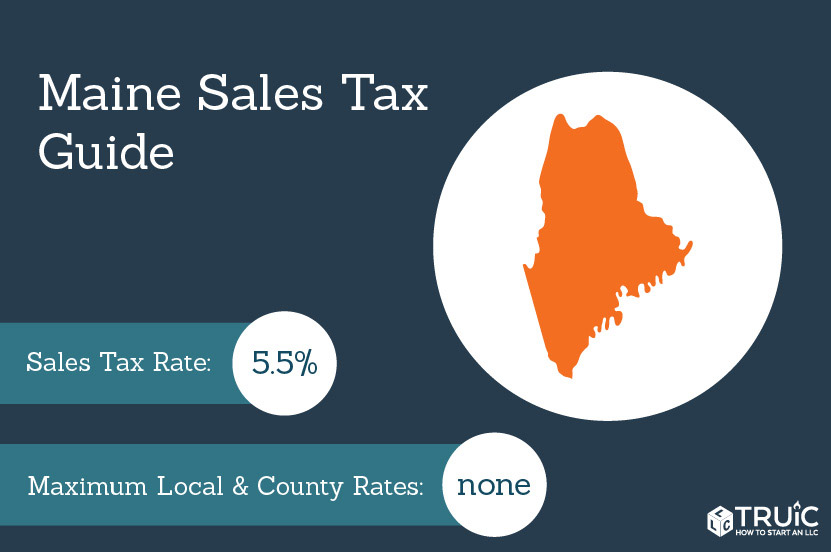

The state of Maine has a simple sales tax system and utilizes a flat state tax rate that was last raised in 2007. Maine State Retail Sales Tax Laws. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on.

Source Maine Sustainability Awards. Retailers can then file an amended return at a later date to reconcile the correct tax owed. Start filing your tax return now.

Retail sales tax is the state of Maines principal tax source. Store all sales that are made from the restaurant facility are subject to tax at the prepared food rate even if the overall facility does not meet the 75 rule. You can read Maines guide to sales tax on prepared food here.

TAX DAY IS APRIL 17th - There are 181 days left. The maine sales tax rate is 55 as of 2022 and no local sales tax is collected in addition to the me state tax. About the Maine Sales Tax.

The Maine Democrats Pet Food Tax Hike bill has been recalled from Gov. Maine state retail sales tax laws. Janet Mills of supporting an increase in the gas tax.

Prepared food containing Medical Marijuana is subject to tax at 8. The Maine race for governor has unleashed a torrent of television and digital ads many containing dubious claims omissions of context or outright falsehoods. The Maine House Democrats just passed a pet food tax hike.

The ad by the Maine Families First political action. It is written in a relatively informal style and is intended to address issues commonly faced by persons such as supermarkets grocery stores and. Several examples of exceptions to this tax are most grocery.

In the state of Maine legally sales tax is required to be collected from tangible physical products being sold to a consumer. Food and supplies essential to the care and maintenance of seeing-eye dogs used to assist blind people are exempt from sales tax. Maine state retail sales tax laws.

This state has special 8 sales tax rates for lodging. The maine sales tax rate is 55 as of 2022 and no local sales tax is collected in addition to the me state tax. Obligations under Maine tax law.

Pet food tax hike stopped in its tracks. Returns are due no later than the 15th of the month. If you have any questions please contact the MRS Sales Tax Division at 207 624-9693 or.

Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns.

Online Menu Of Dills Maine Lobster Shack Restaurant Berthoud Colorado 80513 Zmenu

Food Truck Lunch Friday Community Events Calendar City Of Richmond

The Most And Least Tax Friendly Us States

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

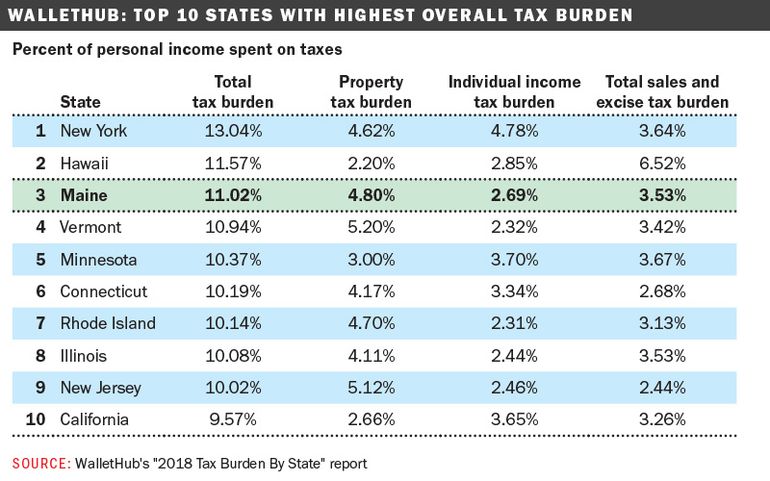

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

A Tax Day Event Veterans For Peace Maine

Potato Planting Finishes Food Processing Tax Credit Signed Fiddlehead Focus

Maine Revenue Services Sales Fuel Amp Special Tax Maine Gov

5 States Without Sales Tax Thestreet

Maine Sales Tax Small Business Guide Truic

I Team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

Me Income Tax Deadline Extended Food Banks Boating And Fishing News Maine Responds More

Sales Tax On Grocery Items Taxjar

![]()

Opinion Fed Data Shows Families Fared Better When Child Tax Credit Came Monthly Maine Beacon

Severe Recession Without Aid Could Shrink Maine Government Revenue For Years Portland Press Herald